For instance, we see consistent labor costs throughout the year except in July. Moreover, costs arising from Scooby Snacks can be a mixed cost because it has fixed and variable components. You can interpret this chart in many different ways, and it can aid you in decision-making. The blue line represents current year data, while the gray line represents previous year’s data. You can use this year-over-year comparison to spot seasonality in revenues and expenses.

Mobile App: Tie

If you’re planning to expand your business but need additional capital, the CFO will help you forecast the business’s financials, craft business plans, and determine the optimal capital structure. If you’re using Xero or QuickBooks, both the desktop and mobile apps will connect to your account and provide information like scorecards and metrics. Using the app, you can keep track of business performance by looking at dashboards and auto-generated reports. You can view profit and loss details, revenues, direct costs, and net income. Offers less expensive plans for businesses that need tax support and a dedicated accountant, but not bookkeeping assistance.

The target audience of Bookkeeper360 service

The dedicated bookkeeper will meet you monthly to fix your books and generate monthly reports. Bench is a worthy alternative to Bookkeeper360 if you’re looking for a tech-savvy provider that focuses largely on bookkeeping. Bench is also a great option if you don’t already use accounting software — as it has its own software platform. Unlike Bookkeeper360 bookkeeper360 review and Bookkeeper.com, Bench offers the same service regardless of your plan, the price only changes based on the amount of your monthly expenses. If you’re looking for a Bookkeeper360 alternative that is focused on bookkeeping, you might consider Bench. Best of all, Bookkeeper360 integrates directly with your favorite payroll solutions like Gusto and ADP.

More Bookkeeping Service Reviews

Additionally, Bookkeeper360 offers custom app integrations based on specific project and business needs. Bookkeeping is the core service that Bookkeeper360 offers and is available by signing up for a consultation with its U.S.-based team. Our 100% US-based team utilizes technology to manage your accounting with a personalized touch.

What level of support does Bookkeeper360 offer?

- Bookkeeper360 assigns US-based bookkeepers—who are employees, not contractors or freelancers—to keep your books up to date.

- It means you must schedule on-time employee payments, calculate taxes correctly and ensure every financial transaction is in line with the law.

- For businesses aiming to scale, especially in industries like tech, hiring for fractional CFO services can be the key to unlocking real, measurable results.

- On the whole, Bookkeeper360 is a good solution for startup and growing companies.

- If you have more than 30 employees, you have to contact them directly to determine the cost of its payroll services.

- Offers less expensive plans for businesses that need tax support and a dedicated accountant, but not bookkeeping assistance.

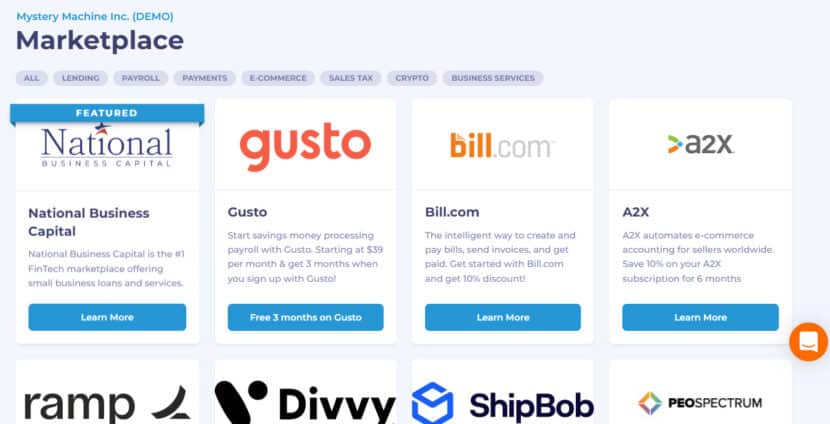

Founders share the time saved and money made with clever use of artificial intelligence. For businesses aiming to scale, especially in industries like tech, hiring for fractional CFO services can be the key to unlocking real, measurable results. If you’re looking for a flexible stay-at-home job, part time or full time, you can become a remote (virtual or online) bookkeeper with little to no experience or degree. A software’s ability to integrate and be compatible with other supported platforms is essential in enhancing user experience. In addition, you can customize the features and integrations to match your preferences. This feature makes Bookkeeper360 stand out because it simplifies the bookkeeping process.

Although Bench does not provide tax services, it can work directly with your CPA during tax time or connect you to a tax professional in its network. After setting up your accounting system, you’ll be able to use the Bookkeeper360 cloud-based platform to communicate and work with your bookkeeper or accountant. At the very least, you can expect most bookkeeping services to input transactions, reconcile accounts and send you financial statements regularly. Most services touch base monthly, but in some cases, you can pay extra to receive weekly reports. Depending on the company, you can speak with your bookkeeper (or team of bookkeepers) as often as you’d like or at least a few times per month.

The UI and UX are the two most crucial aspects of any SaaS product, and here is why. Another standout feature of Bookkeeper360 is it integrates with over 5000 financial institutions. It helps you to get bank feed on any transaction importing, reconciliation, and more. The goal is to help you understand if Bookkeeper360 is the ideal platform for your business needs. See our overall favorites, or choose a specific type of software to find the best options for you.

The good thing is you can contact the Bookkeeper through the Bench platform whenever you need input. The major difference between Bench and Bookkeeper is that Bench doesn’t offer tax services. It is one of the best alternatives to Bookkeeper360 because it focuses on bookkeeping. Bench accounting pairs you with a dedicated bookkeeper who will categorize and help you reconcile your accounts. It offers accounting capabilities with excellent features at a reasonable price. Through the software, you will track due dates and payments and streamline the approval process.